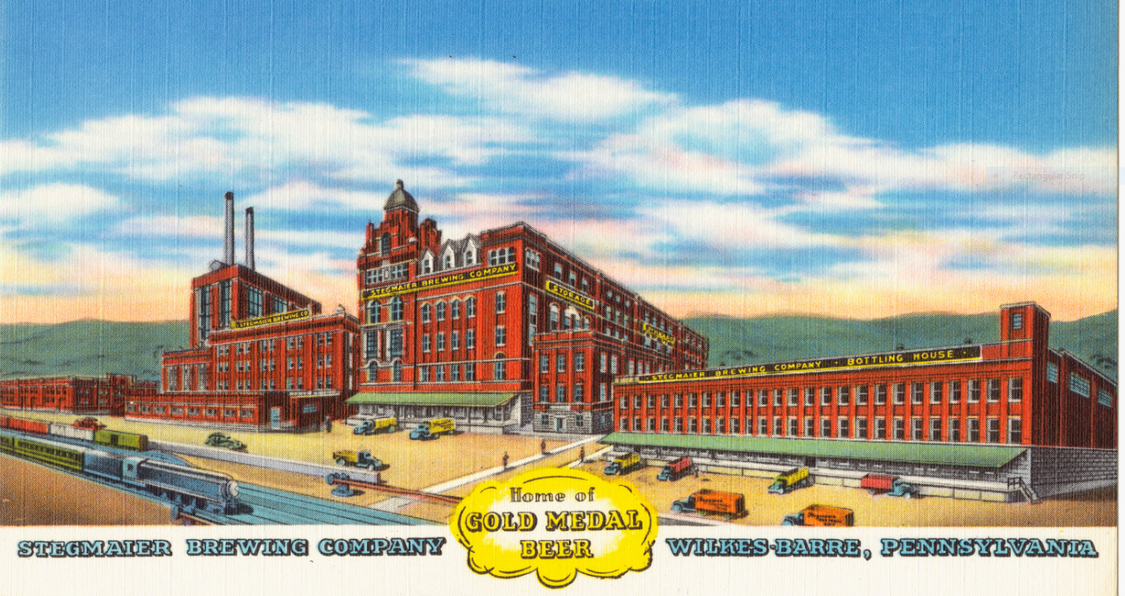

As we mark the 100th anniversary of the implementation of Prohibition, it is good to reflect on the fact that many buildings related to Pennsylvania’s historic brewing industry remain.

Continue readingCategory: Financial Incentives for Historic Preservation (Page 4 of 7)

In Pittsburgh’s Northside, the historic tax credit program helped transform 148 historic buildings into new homes for over 250 residents.

Continue readingThe 1908 Metropolitan Opera House on North Broad Street is undoubtedly a preservation success story. The Met, as its affectionately called, was recently rehabilitated and reopened with thanks, in part, to the federal historic tax credit program.

Continue readingIt wouldn’t be New Years without a top 10 recap, and I didn’t want to disappoint you by not giving our faithful readers a recap of their favorite blog.

Continue reading

Testimonials in Pennsylvania’s Preservation Tool Box

One of PA SHPO’s core missions is to educate the commonwealth’s citizens about state and federal historic preservation programs. We can’t do it alone, so we do our best to provide interested citizens, advocates, and partners with the tools to help communicate what historic preservation is and why it matters.

Continue reading

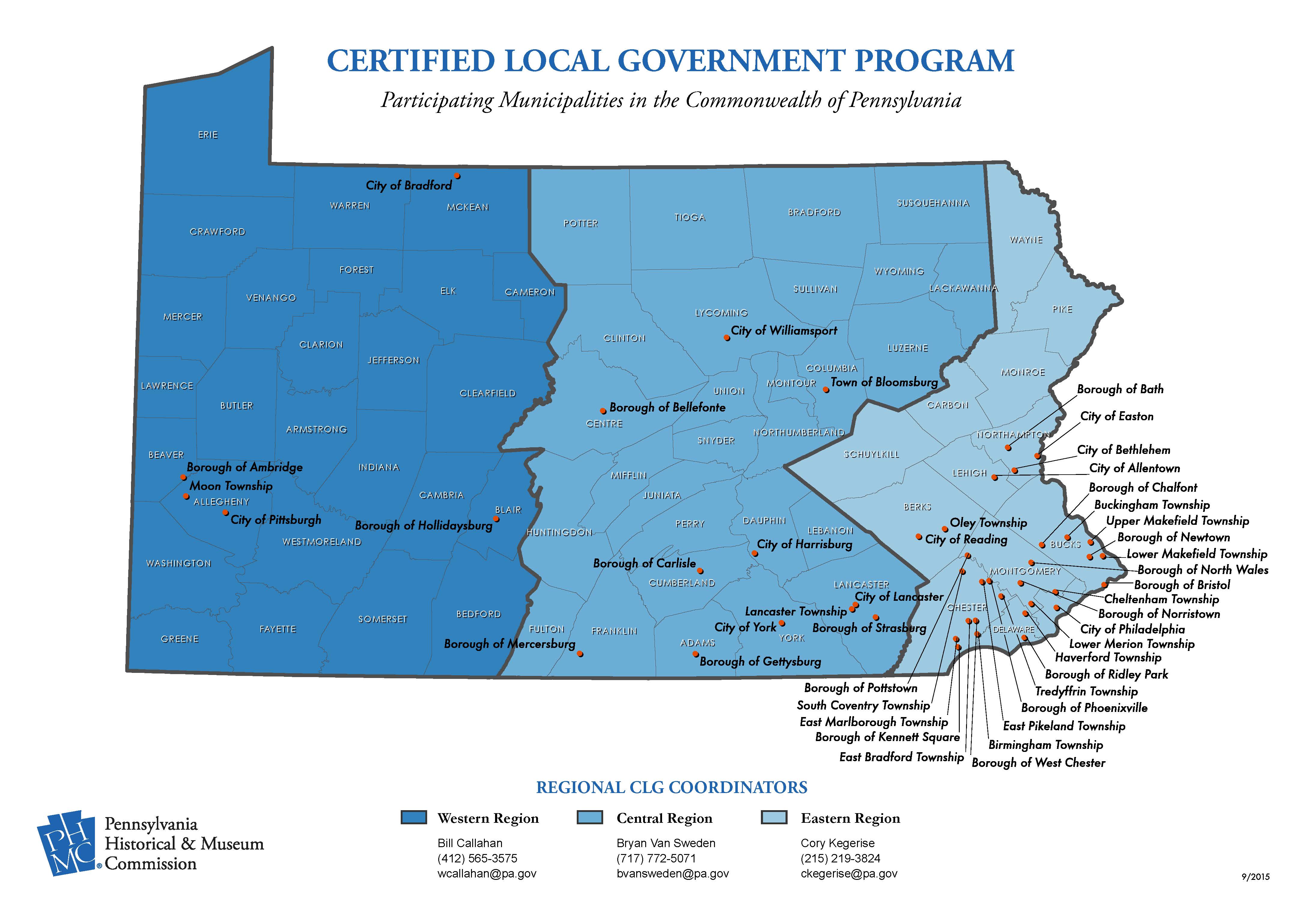

5 Things to Know about the New and Improved Certified Local Government Program

The Certified Local Government (CLG) program is one of the unsung heroes of the historic preservation world. Less well known than the National Register, Historic Rehabilitation Tax Credits and Section 106, the CLG program’s utilitarian name has surely contributed to the bewilderment about what the program can do for community-level preservation efforts over the years. It’s also fair to say that the CLG program hasn’t been given the proper attention necessary to reach its full potential – until now! In late 2018 the PA SHPO rolled out revised guidelines for the CLG program in Pennsylvania, complete with a renewed sense of purpose, clearer goals and revamped technical assistance and grant programs. So, here are five things you wanted to know about the new and improved CLG program in Pennsylvania but didn’t know to ask. Continue reading

Update! Pennsylvania’s State Historic Preservation Tax Credit

Lots of work has been going on these past few weeks to reauthorize and expand Pennsylvania’s state Historic Preservation Tax Credit. Take a look! Continue reading

2019 as the Year of the Pennsylvania Historic Preservation Tax Credit?

The Chinese calendar says 2019 is the Year of the Pig. I’m feeling optimistic and thinking that 2019 might also be the Year of the Pennsylvania Historic Preservation Tax Credit.

5 Things to Know from the PA SHPO

This week’s post brings you “5 Things” to know for November and December 2018. Take a breather from your Thanksgiving holidays and read about new staff, important deadlines, and a fun way to show what you’re thankful for. Continue reading

Summer 2018 PA Historic Tax Credit Update

After a chaotic winter where one of the federal government’s most successful historic preservation programs over the past 40 years – the Historic Preservation Tax Credit – was almost eliminated during federal tax reform, there is a lot to catch up on relating to both the federal and Pennsylvania historic tax credit programs. Continue reading

Recent Comments