Rehabilitating a religious property, like a church, using historic tax credits can be very challenging because it is often difficult to match the building’s desired new use with the historic floor plan and character-defining spaces. Design professionals and building owners have to negotiate a difficult balance between preserving a church’s large, open sanctuaries with the need for income-producing spaces like apartments or multi-tenant office spaces.

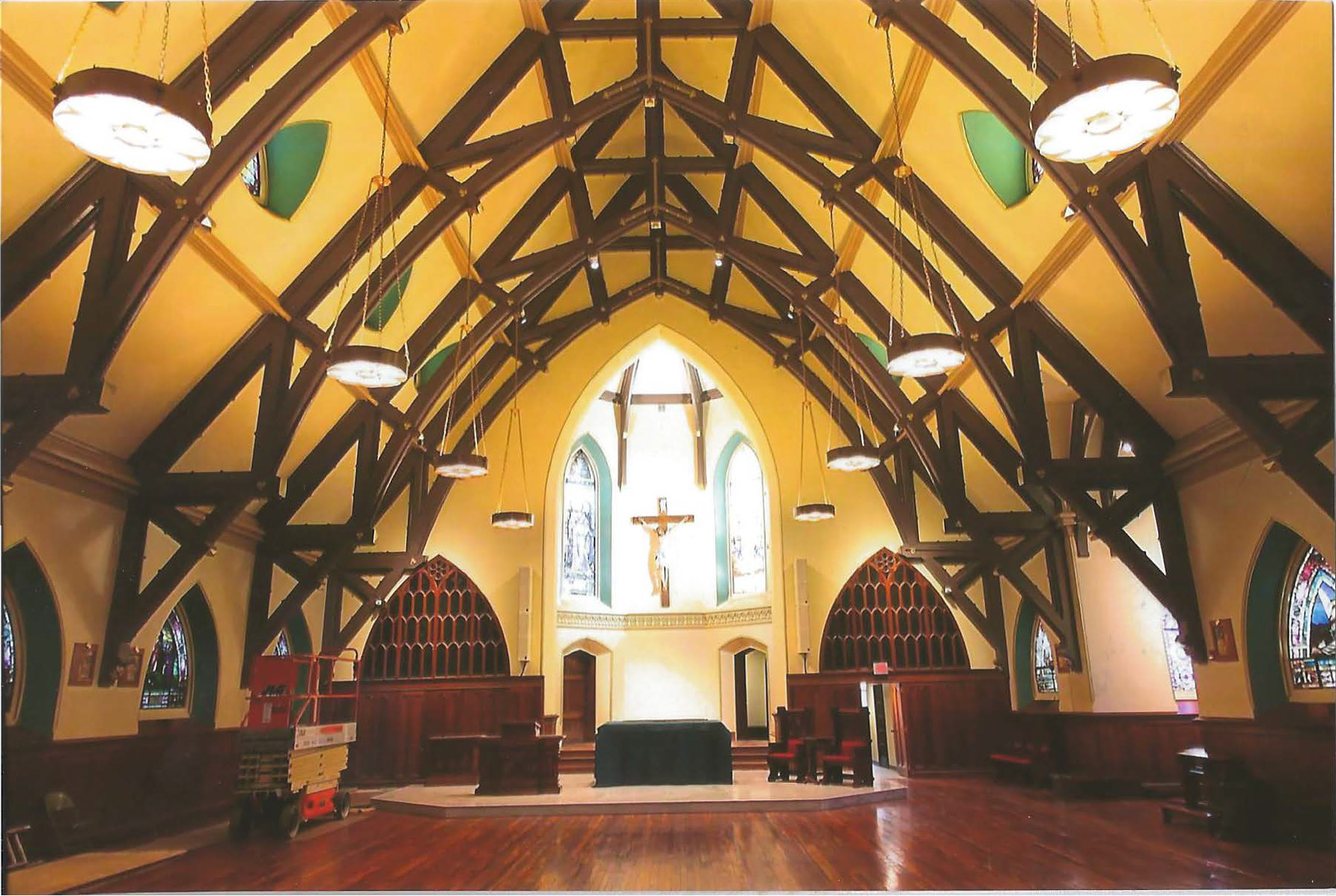

The rehabilitation of Wilkes-Barre’s Memorial Presbyterian Church is a good example of how to apply the Secretary of the Interior’s Standards for Rehabilitation, which are the guiding principles for historic tax credit projects, to church buildings.

Continue reading

Recent Comments