Since the opening date of the application period on December 1, 2014, I have received many calls and inquiries about the status of Year 2 of Pennsylvania’s Historic Preservation Tax Credit program. By the closure of the application period on February 1, 2015, the Department of Community and Economic Development (DCED) received 30 applications for the second round.

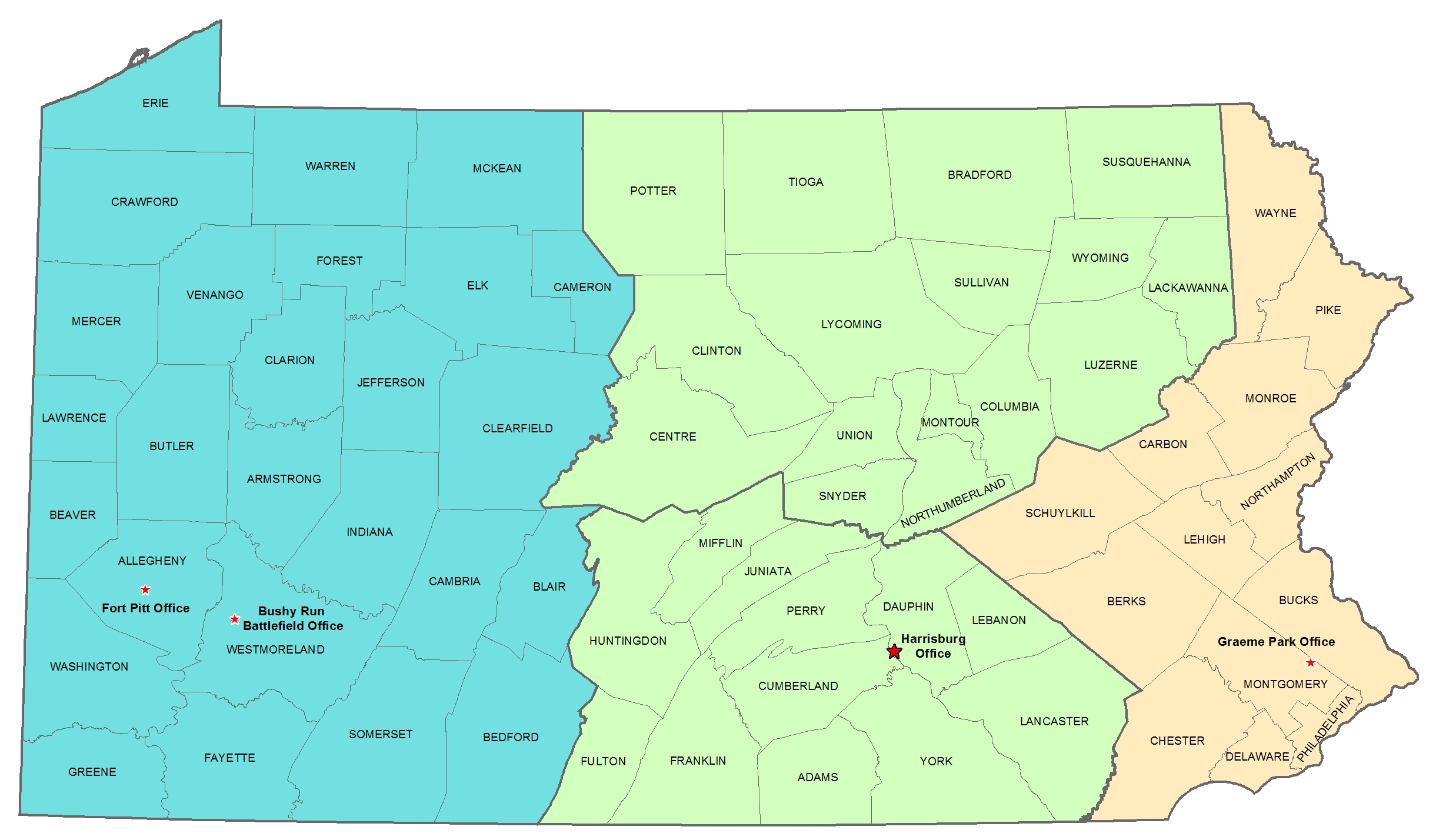

Over a long review period which lasted until mid-April, PHMC reviewed the applications to ensure applicants owned qualified historic buildings and that proposed rehabilitation plans met the Secretary of the Interior’s Standards for Rehabilitation. As the qualified applications far exceed the limited $3 million in available credits, DCED used a fair and balanced selection process based on a first -come, first serve basis with regional distribution to select the first round of projects. Continue reading

Bite off more than you can chew, then chew it. Plan more than you can do, then do it.

Bite off more than you can chew, then chew it. Plan more than you can do, then do it.

Recent Comments