Q: What do the National Register of Historic Places, Section 106 consultation, Federal Historic Preservation Tax Credits, Certified Local Government grants, Tribal preservation activities, and Historically Black Colleges and Universities have in common?

A: All of these programs (and more) are supported by the Historic Preservation Fund.

The next logical question you might be asking yourself is – what is the Historic Preservation Fund (HPF)? The HPF was established in 1976 as part of the amendments to the National Historic Preservation Act (NHPA) and is the primary Federal funding mechanism for State Historic Preservation Offices (like PHMC). The National Park Service administers grants from the HPF to States, Territories, and Tribes to implement various programs authorized by the NHPA, as well as other initiatives that advance historic preservation needs in that state.

The legislation authorizing the HPF sunsets on September 30, 2015, so we thought this was a good time to share some of the finer details about the fund and its impact nationally and here in Pennsylvania. Legislation extending the HPF for another 10 years has been introduced and co-sponsors include Rep. Matt Cartwright (PA-17) and Rep. Ryan Costello (PA-6).

What does the HPF Support?

Each year, the National Park Service publishes an annual report for the HPF. You can read 2014’s report here: http://www.nps.gov/shpo/index.html

A number of significant historic preservation programs are funded primarily by the HPF. State, Territorial, and Tribal Historic Preservation Offices receive grants to fund operations, including the professional staff that review National Register nominations and Tax Credit applications. At least 10% of the funds that SHPOs receive from the HPF are awarded to Certified Local Governments (CLGs) as subgrants each year. These grants support planning, historic resource surveys, design guidelines, consultant services, etc. in communities that have preservation ordinances and implement best practices for local preservation programs.

The HPF (when appropriated by Congress) also supports Historically Black Colleges & Universities, and was the source for the Save America’s Treasures and Preserve America programs. Neither of the latter programs has been funded in the Federal budget since 2011. From time to time, Congress has authorized special initiatives that are funded with funds from the HPF. Recently, grants have been available to preserve sites related to the confinement of Japanese Americans during World War II, the survey of places significant to communities that are traditionally underrepresented in the National Register, and disaster planning and response. Congress has recently proposed appropriating HPF funds for sites related to the Civil Rights movement throughout the U.S.

So Where Does the Money Come From?

The HPF is funded by a portion of the revenues the Federal government earns from leasing the Outer Continental Shelf for oil & gas drilling, not tax revenue. The HPF is modeled on the Land & Water Conservation Fund, which was established a decade earlier and is also funded by oil & gas leases. Each year $150 million in oil & gas lease revenue is credited to the HPF (that’s the maximum allowed by law) awaiting Congressional action. During the annual Federal budget process Congress decides how much of the $150 million authorization to appropriate for the various programs funded by the HPF for the coming year.

Just How Much Money Is There?

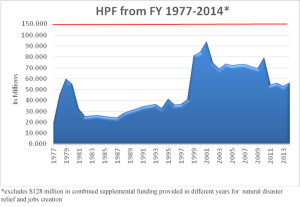

Appropriations history for the Historic Preservation Fund from 1977-2014. Used with permission from the National Conference of State Historic Preservation Officers.

Good question. While Congress is authorized to appropriate $150 million toward the various HPF supported programs each year, the actual appropriations have historically averaged between 1/3 and ½ of that amount. Funding reached its peak in the late 1990s ($90 million+) and early-mid 2000s when Save America’s Treasures and Preserve America were being launched. Those programs were defunded in 2010-2011 and the total HPF appropriation dropped back to just under $60 million, where it has remained steady for the last several years. For fiscal year 2015, Congress provided a total of $56.41 million from the HPF. Of this amount, $46.925 million was awarded to State Historic Preservation Officers and $8.985 million for Tribal Historic Preservation Officers. Congress also provided $500,000 for projects that will increase diversity in the National Register of Historic Places and in the National Historic Landmarks programs.

What is Pennsylvania’s Share of the HPF?

Each budget year Congress divvies up the HPF appropriation for specific programs, one of which is grants to states. That amount is then apportioned to the various states using a formula that factors in a variety of variables like population, land area, etc. Pennsylvania ranks near the high end of the apportionment scale and receives a little more than $1 million annually to support the work of the State Historic Preservation Office. Ten percent (10%) of that grant is awarded to CLGs through a competitive subgrant process. The amount appropriated for state grants has remained level for the last few years, so Pennsylvania’s piece of the pie has remained level also.

HPF grants also require states to provide a minimum 40% match from non-Federal sources. The match can be either cash or in-kind, though most states (including Pennsylvania) provide both in the form of office space, support personnel, state appropriations, grant programs, etc. Matching funds contributed by CLGs as part of their subgrant projects also count toward that total.

Why Does the HPF Matter to My Pennsylvania Community?

This is always a tricky question, and obviously a highly personal one to answer. Here are a few options for you to consider as you ponder:

– Chances are there’s at least one building, district, bridge, or other historic resource in your community that you think is pretty important and is listed on the National Register of Historic Places.

The Steelton High School complex in Steelton, Dauphin County, is listed in the National Register of Historic Places. It has been rehabilitated into affordable housing using the Rehabilitation Investment Tax Credits.

– Maybe you’ve stayed in a historic hotel that’s had a makeover (like the Abraham Lincoln Hotel in Reading), or work in an old factory that’s been turned into offices (like the Philadelphia Navy Yard), or live in an apartment that used to be a school (like the Steelton High School), or have shopped in a building that used to be a textile mill (like the Bellemonte Silk Mill in Hawley). All of these buildings and hundreds more throughout the Commonwealth have been rehabilitated using Federal Historic Preservation Tax Credits. Pennsylvania is consistently in the top 5 states in terms of numbers of projects and dollars invested in tax credit projects. That means that not only do old buildings find new uses, but communities experience new investment and revitalization along with the projects. PHMC staff are the first level reviewers and help applicants through their projects with the support of the HPF.

– You might live in one of Pennsylvania’s 45 Certified Local Governments, and perhaps your community has received a CLG grant to survey its historic buildings, develop design guidelines, or prepare a feasibility study for bringing an old building back to life. Maybe you’ve visited one of these communities (like Lancaster, or Allentown, or Bradford) and been charmed by the character and vitality of the communities. CLG grants come from the HPF!

No matter what your specific example might be, the odds are good that your community has benefitted directly or indirectly from the Historic Preservation Fund. Maybe it was a grant, maybe it was some research you found on our website, or maybe it was some technical assistance from one of the PA SHPO’s staff. Whatever the reason, we hope it was helpful – and now you know where that help came from!

Leave a Reply